Understanding Competition Trading

In today’s dynamic business landscape, competition trading has emerged as a significant practice that influences how companies operate, compete, and thrive in their respective markets. From IT services and computer repair to financial services and financial advising, understanding the principles of competition trading is crucial for businesses looking to gain an edge.

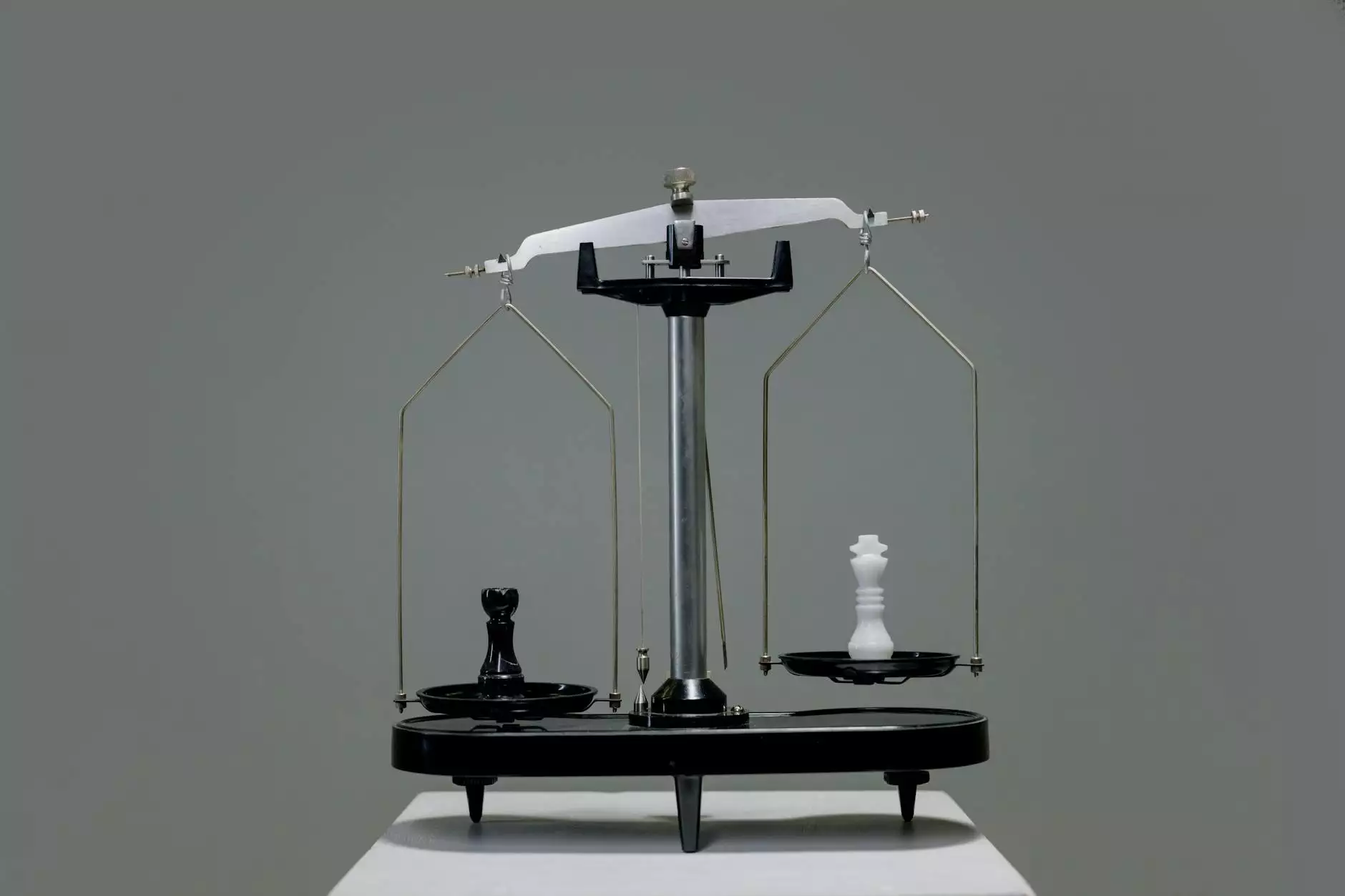

What is Competition Trading?

Competition trading refers to the strategic interactions between businesses that are vying for the same market share and customer base. This can involve various tactics, including pricing strategies, marketing campaigns, and service innovation. In essence, competition trading is about understanding and responding to the actions of competitors in a way that maximizes a company’s market position.

The Importance of Competition Trading

The practice of competition trading holds immense importance for several reasons:

- Market Dynamics: It helps businesses understand market trends and consumer preferences.

- Innovation: Encourages firms to innovate and improve their services or products.

- Pricing Strategies: Assists in developing competitive pricing strategies that attract customers.

- Risk Management: Aids in identifying potential risks posed by other market players.

The Role of Competition Trading in Different Industries

Competition trading plays a critical role in various sectors, each with unique characteristics and challenges. Let’s delve deeper into how it impacts major industries.

IT Services and Computer Repair

In the realm of IT services and computer repair, competition trading is particularly intense. Businesses must offer both high-quality services and competitive prices to attract customers. Here are some ways in which this unfolds:

- Service Differentiation: Companies often focus on providing specialized services, such as data recovery or network security, to stand out.

- Customer Experience: A superior customer experience can be a significant competitive advantage in this industry.

- Strategic Partnerships: Collaboration with software vendors can enhance service offerings and attract more customers.

Furthermore, understanding your competition’s strengths and weaknesses can provide vital insights for refining your business strategy.

Financial Services

In the financial services sector, competition trading is critical for maintaining relevance and profitability. The stakes are high, and firms must navigate various competitive strategies:

- Pricing Models: Innovative pricing models, such as zero commissions or tiered pricing, can lure clients.

- Technological Advancements: Utilizing technology to provide efficient services (like robo-advisors) can offer a competitive edge.

- Client Education: By educating clients on complex financial products, firms can strengthen client loyalty and improve retention rates.

In this fast-paced environment, competition not only drives prices down but also encourages financial advisors to elevate service levels.

Financial Advising

Competition trading in financial advising is about more than just numbers; it’s about building relationships. Here’s how competition shapes the landscape:

- Customized Solutions: Tailoring financial advice to meet individual client needs is crucial in differentiating services.

- Brand Trust: Establishing a reputable brand through quality advice and ethical practices can create lasting client relationships.

- Online Presence: A strong online presence and effective use of digital marketing strategies can enhance visibility and attract new clients.

As investors become more knowledgeable, their expectations also rise, making it imperative for financial advisors to continuously adapt to stay competitive.

Strategies for Effective Competition Trading

To thrive in a competitive landscape, companies must adopt effective strategies that leverage competition trading principles. Here are some key strategies:

1. Market Analysis

Conducting thorough market analysis to understand your competitors and consumer needs can inform your strategic decisions. Tools like SWOT analysis can help identify strengths, weaknesses, opportunities, and threats.

2. Pricing Strategies

Developing effective pricing strategies can differentiate your offerings. Consider value-based pricing where prices are set based on perceived value to customers rather than solely on costs.

3. Innovation and Adaptation

Continuous innovation is vital in staying ahead. This could mean adopting new technologies or improving service delivery methods. Adaptability allows businesses to respond quickly to changing market conditions.

4. Strategic Partnerships and Networking

Forming alliances and partnerships with other businesses can enhance service and expand customer reach. Networking can also lead to referrals that boost your clientele.

5. Focus on Customer Experience

A focus on providing a superior customer experience can lead to customer loyalty and positive word-of-mouth referrals. Gathering and addressing feedback is essential for enhancing service.

The Future of Competition Trading

The future of competition trading is poised for further evolution as technology continues to reshape various industries. Here are key trends to watch:

- Artificial Intelligence: AI will play a significant role in analyzing competition and consumer behavior, allowing for more informed decision-making.

- Increased Transparency: Customers are demanding greater transparency regarding pricing and service quality, pushing businesses to adopt more ethical practices.

- Hyper-Personalization: The move towards hyper-personalized services will continue, driven by customer data and preferences.

Businesses that can anticipate these trends and adapt their competition trading strategies accordingly will have a significant advantage in capturing the market.

Conclusion

Competition trading is not merely a buzzword; it is a fundamental aspect of modern business strategy. By understanding the competitive landscape, adapting to market dynamics, and focusing on customer satisfaction, businesses can not only survive but thrive in their respective industries. Bullrush.com is here to support your journey in mastering competition trading through our comprehensive IT services, computer repair, financial services, and financial advising.